Xero Plans & Pricing Are Changing

Xero is chaning is product lineup and pricing in Australia from 1 July 2024.

What's Changing?

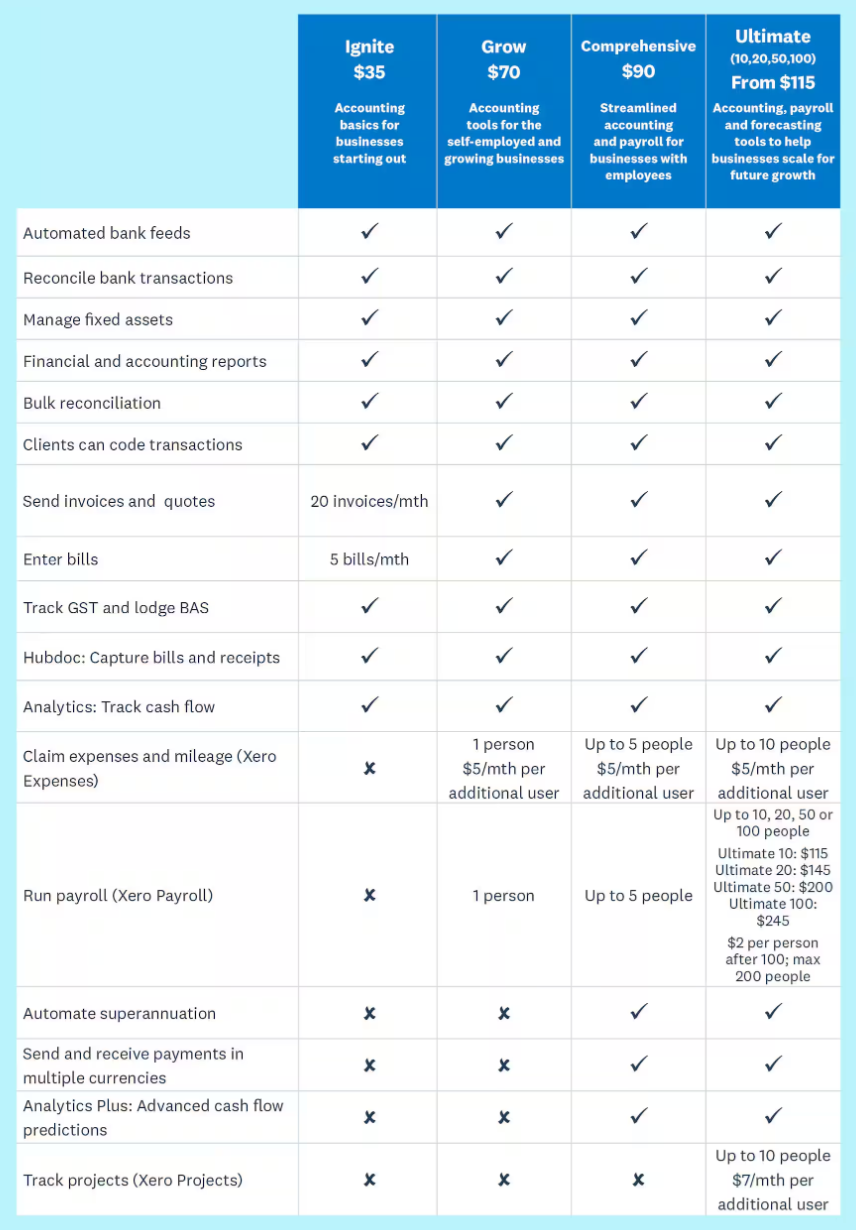

Xero is launching three new streamlined business plans (Xero Ignite, Xero Grow and Xero Comprehensive), and enhancing the Ultimate plan in Australia. The new plans will replace Xero’s Payroll Cashbook, GST Cashbook, Payroll Only, Starter, Standard and Premium plans which will no longer be sold from 1 July 2024.

The company says that this will mean easier access to tools (including cash coding in all of the new business plans), more bundled features, and fewer plans and add-ons to navigate.

Existing add-ons will no longer be available for separate purchase from this date. Any new subscriptions from 1 July 2024 can only be added to a new plan. Enhancements to Ultimate plans will also begin from this date, which include Xero Expenses and Xero Projects for 10, instead of the current 5.

Where we hold the subscription for Xero on your behalf, we will automatically apply the new pricing once your plan is converted.

Clients who pay us via Agreed Price Service Plan will continue to receive 10% discount on new plans.

When Will Your Plan Change?

From 1 July 2024:

- Xero will begin moving subscribers to the new plans in phases, taking into account the subscriber’s current plan (and any add-ons).

- This move will start with Premium 10–100 plans which will convert to the equivalent tier Ultimate plan at the new Ultimate pricing on 1 July 2024

- Xero says that they intend to move subscribers to new plans by March 2025

- Alternatively, you can choose to move to new plans before this automatic conversiontakes place if you wish

- If you want to upgrade, downgrade, remove an add-on from your plan, or transfer a subscription after 1 July 2024, one of Xero's new plans will need to be chosen

- Once you have moved to a new plan, the previous plan will no longer be available

If you have questions about the new Xero plans or the conversion process, please contact us.